-

Audit approach

Designing a tailored audit programme customised for your business, we will combine the collective skill and experience of assurance professionals around the world to deliver an audit that is efficient and provides assurance to your key stakeholders.

-

Audit methodology

We have adopted Grant Thornton International's Horizon audit approach and Voyager software, a revolutionary paperless audit designed to achieve a consistent standard of audit service.

-

MFRS

At Grant Thornton, our MFRS advisers can help you navigate the complexity of financial reporting.

-

Our local experts

Our local experts

-

Tax advisory & compliance

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

Corporate & individual tax

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax & Global mobility services

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Indirect tax

Our indirect tax specialists help clients in effective planning; assist to bring clarity to the legislation; assist and advise in audits or investigations. It is important for all entities, whether or not required to register for Sales Tax or Service Tax to analyse the impact of the taxes on their business operations, their revenues and expenses, and their customers and suppliers.

-

Tax audit & investigation

Tax audit and investigation

-

Transfer pricing

Transfer pricing

-

M&A, Restructuring & Forensics

Forensic

-

Corporate finance

Whether you are raising capital, disposing of a business or seeking a wider market for your company's shares on a stock market, we are ready to help make it a successful and stress-free experience for you.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Recovery and reorganisation

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

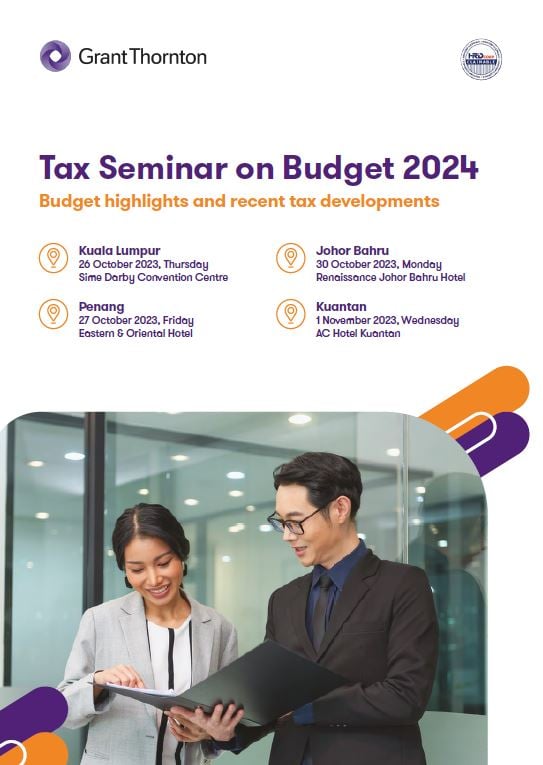

Join us in our full day seminar to get insights from our distinguished guest speaker and esteemed tax leaders on the Budget 2024 proposals and participate in an informative panel discussion and Q&A on the latest tax developments.

Malaysia’s Budget 2024, themed “Madani Economy: Empowering the People” is set to be tabled on 13 October 2023 by our Finance Minister Dato’ Seri Anwar Ibrahim.

Crafted with the Ekonomi MADANI framework in mind, Budget 2024 is said to be the continuation of the Madani Budget that was tabled in February with the focus of spurring the economy and driving greater growth of the industry including small and medium enterprises. Will the Budget 2024 be able to address the people’s challenges, drive economic growth and also increase our country’s competitiveness?

DATES & LOCATION

- KUALA LUMPUR - 26 October 2023, Thurs | Sime Darby Convention Centre

- PENANG - 27 October 2023, Fri | Eastern & Oriental Hotel

- JOHOR BAHRU - 30 October 2023, Mon | Renaissance Johor Bahru Hotel

- KUANTAN - 1 November 2023, Wed | AC Hotel Kuantan

PROGRAMME - KUALA LUMPUR

| 8.30am | Registration |

| 8.45am | Opening Remarks |

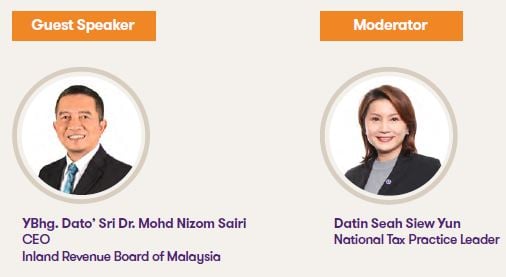

| Datin Seah Siew Yun | |

| National Tax Practice Leader | |

| 9.00am | Conversation with the CEO of the Inland Revenue Board |

| Moderator: Datin Seah Siew Yun, National Tax Practice Leader | |

| Speaker: YBhg Dato' Sri Dr. Mohd Nizom Sairi, CEO of the Inland Revenue Board of Malaysia | |

| 10.00am | Morning Refreshments |

| 10.30am | Budget Proposals: Individual Tax |

| Chow Chee Yen, Senior Executive Director of Tax Advisory & Compliance | |

| 11.30am | Budget Proposals: Corporate Tax & Others |

| Chow Chee Yen, Senior Executive Director of Tax Advisory & Compliance | |

| 12.30pm | Lunch |

| 2.00pm | Budget Proposals: Indirect Tax |

| Alan Chung, Senior Executive Director of Indirect Tax & Transfer Pricing | |

| 2.45pm | Capital Gains Tax on Unlisted Shares |

| Chow Chee Yen, Senior Executive Director of Tax Advisory & Compliance | |

| 3.45pm | Latest Updates on Transfer Pricing and SVDP |

| Chan Tuck Keong, Executive Director of Tax Advisory & Compliance | |

| 4.30pm | Q&A |

| 5.00pm | End of seminar & refreshments |

SPEAKERS

SEMINAR FEE

Kuala Lumpur

- RM 500 per participant (Grant Thornton clients & alumni)

- RM 550 per participant (Non-clients)

- *10% discount for 3 or more participants

Johor Bahru, Penang

- RM 380 per participant (Grant Thornton clients & alumni)

- RM 480 per participant (Non-clients)

- *10% discount for 3 or more participants

- Seminar fee per participant is inclusive of 6% Service Tax, seminar materials, refreshments and lunch.

HRD Corp Claimable Courses

• Grant Thornton Malaysia PLT is an approved Training Provider registered under ‘Grant Thornton Malaysia PLT’ (MyCoID: LLP0022494LCA).

• Please do not make any payment if you wish to attend the seminar under HRD Corp Claimable Courses and please notify us.

• Training grant application must be submitted by the participant and grant approval must be obtained from HRD Corp before the commencement of the seminar.

Datin Seah Siew Yun

National Tax Practice Leader, Grant Thornton Malaysia

Seah Siew Yun is the National Tax Practice Leader who oversees the Tax Compliance & Advisory Services for Grant Thornton Malaysia. She is a fellow member of the Chartered Tax Institute of Malaysia (CTIM) and held the position of President from 2017 to 2019. She has more than 30 years’ experience in handling a vast variety of tax advisory, tax audit and tax investigation assignments for both local and international companies covering industries like manufacturing, property development, construction, agriculture, shipping, mining, tourism, education and others. She is also involved in tax advisories for inbound and outbound investments with specialisation in domestic taxes, corporate restructuring, tax incentive applications and other cross border tax specialist services. She is a regular speaker in various taxation seminars and regularly participates in dialogues with relevant government authorities and agencies.

Chow Chee Yen

Senior Executive Director

Tax Advisory & Compliance, Grant Thornton Malaysia

Chee Yen has more than 32 years of experience and was involved in tax engagements concerning cross border transactions, tax due diligence review, restructuring schemes, corporate tax planning, group tax review, inbound investments and sales and services tax.

Chee Yen’s expertise is in high demand and he is a prolific trainer/facilitator for tax workshops and seminars organised by ACCA, CCH, CPA Australia, CTIM, MIA, MAICSA, MICPA and the STAR newspaper. In addition, he conducts in-house training for government ministry, professional firms and corporations as well as guest speaker for national and international conferences.

He is the President of the Chartered Tax Institute of Malaysia (CTIM), a Fellow Member of The Association of Chartered Certified Accountants (FCCA) and a Chartered Accountant of the Malaysian Institute of Accountants (CA). He is also a graduate of the Malaysian Institute of Certified Public Accountants (MICPA) Examinations.

Alan Chung

Senior Executive Director, Indirect Tax & Transfer Pricing

Grant Thornton Malaysia

Alan has more than 25 years of experience in tax compliance, tax advisory and indirect taxation, including a stint as a secondee to the Inland Revenue Board of Malaysia for the implementation of the self-assessment system in Malaysia. He was previously attached to the “Big Four” accounting firms and had headed the Secretariat of the Malaysian Institute of Taxation (now known as the Chartered Tax Institute of Malaysia or CTIM) and served as the Head of Tax of a public-listed company.

Alan is a Fellow of CTIM and a Fellow of CPA of Australia. He is currently a Council Member of CTIM, a member of CTIM’s Technical Committee-Indirect Taxation as well as a member of CPA Australia’s Malaysian Division Council’s Tax Committee. Previously, he was also a Divisional Councillor for CPA Australia’s Malaysian Divisional Council. With a wealth of experience dealing with various government agencies and departments, Alan actively contributes in dialogues with various Government agencies to resolve a myriad of both direct and indirect tax issues.

Chan Tuck Keong

Executive Director, Transfer pricing

Grant Thornton Malaysia

Chan Tuck Keong is the Executive Director of Transfer Pricing. He has over 11 years of experience in preparing tax filings for companies and individuals, tax advisory and handling Transfer Pricing matters involving various industries such as manufacturing, logistics, agriculture, mining, service providers and others. He is a committee member of the Transfer Pricing Sub-Committee of the Chartered Tax Institute of Malaysia.