While a number of Malaysian Financial Reporting Standards were amended as a consequence of the release of MFRS 18, the most significant amendments were made to the following Malaysian Financial Reporting Standards

Designed with our clients in mind, our audit and assurance services focus on critical areas and risks that matter most to your business. The ability to manage...

-

Audit approach

Designing a tailored audit programme customised for your business, we will combine the collective skill and experience of assurance professionals around the world to deliver an audit that is efficient and provides assurance to your key stakeholders.

-

Audit methodology

We have adopted Grant Thornton International's Horizon audit approach and Voyager software, a revolutionary paperless audit designed to achieve a consistent standard of audit service.

-

MFRS

At Grant Thornton, our MFRS advisers can help you navigate the complexity of financial reporting.

-

Our local experts

Our local experts

At Grant Thornton, tax is a key part of our organisation and our tax teams can offer you a range of solutions.

-

Tax advisory & compliance

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

Corporate & individual tax

Our teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax & Global mobility services

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Indirect tax

Our indirect tax specialists help clients in effective planning; assist to bring clarity to the legislation; assist and advise in audits or investigations. It is important for all entities, whether or not required to register for Sales Tax or Service Tax to analyse the impact of the taxes on their business operations, their revenues and expenses, and their customers and suppliers.

-

Tax audit & investigation

Tax audit and investigation

-

Transfer pricing

Transfer pricing

As your business grows, our advisory services are designed to help you achieve your goals. Successful growth often means navigating a complex array of...

-

M&A, Restructuring & Forensics

Forensic

-

Corporate finance

Whether you are raising capital, disposing of a business or seeking a wider market for your company's shares on a stock market, we are ready to help make it a successful and stress-free experience for you.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Recovery and reorganisation

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

Sustainability and Climate Change Services

Japan Desk in Grant Thornton Malaysia was established in October 2013 to serve as bridge between Malaysia and Japan.

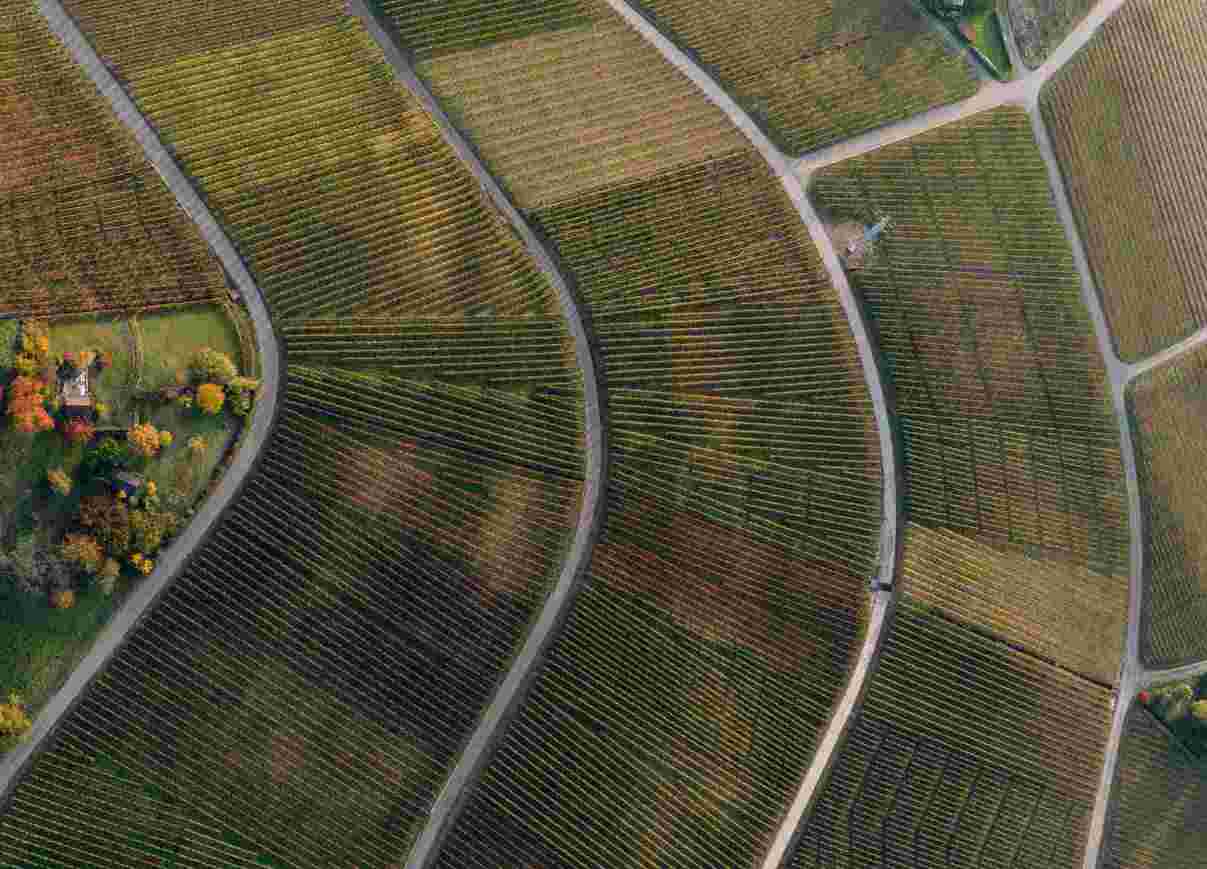

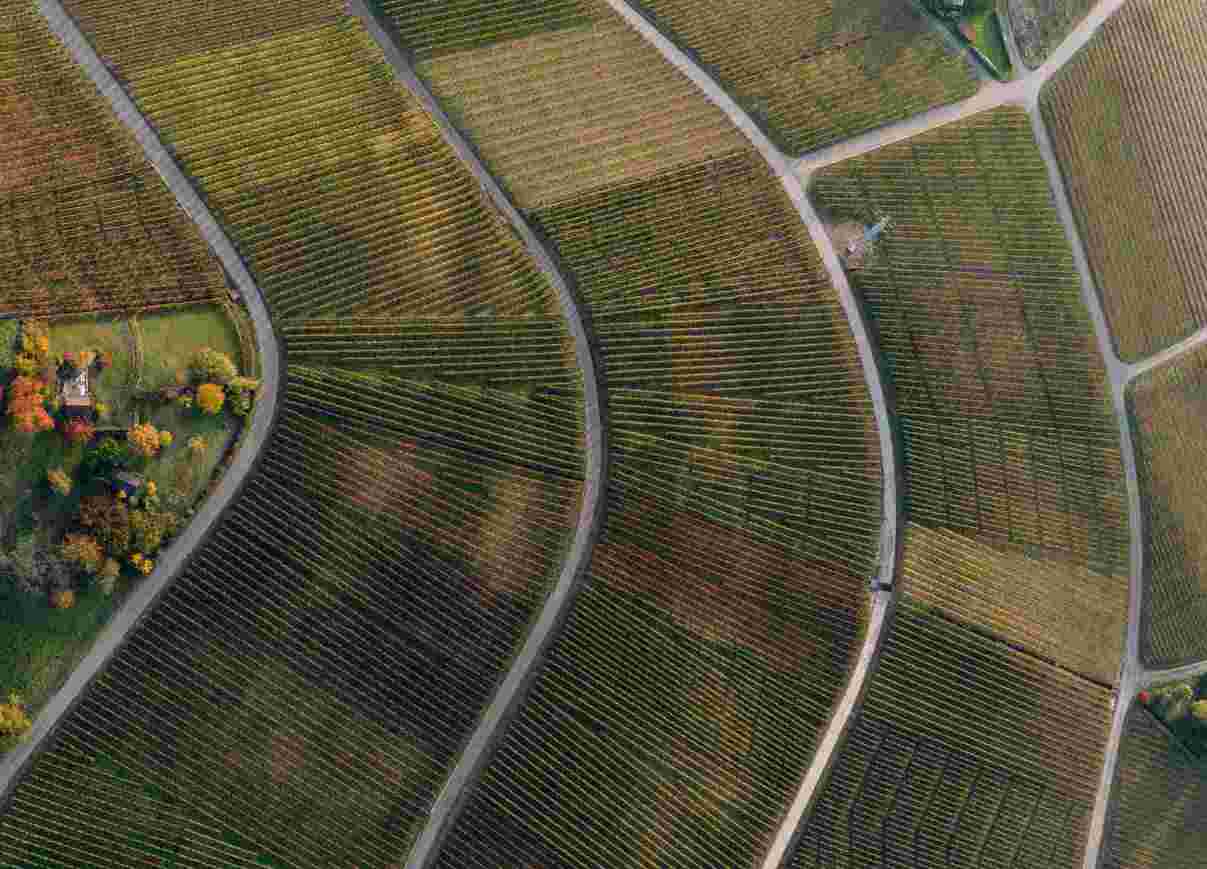

Our expertise in the property industry in ASEAN

Support clients in identifying strategic business or investment partners in China or other region

Our expertise in the retail industry in ASEAN

Our expertise in the technology industry in ASEAN

With our unique culture and opportunities, Grant Thornton Malaysia is a place where you can grow. Wherever you are in your career, we help you to make a...

At Grant Thornton, talented people are at the heart of our strategy and drive all of our successes in more than 140 countries.

-

Our values

We have six CLEARR values that underpin our culture and are embedded in everything we do.

-

Learning & development

At Grant Thornton we believe learning and development opportunities help to unlock your potential for growth, allowing you to be at your best every day. And when you are at your best, we are the best at serving our clients

-

In the community

Many Grant Thornton member firms provide a range of inspirational and generous services to the communities they serve.

Experienced hires

Fresh graduates

-

Internship

Internship

-

Internship

Internship

Vacancies listing

Filter insights by:

Our latest insights

MFRS

Get ready for MFRS 18 - Consequential amendments to other Malaysian Financial Reporting Standards

MFRS

Get ready for MFRS 18 - New and enhanced guidance on aggregation and disaggregation of information in the financial statements

Under the new requirements of MFRS 18, items of income and expense are not classified based on their own nature, but rather they are classified based on the nature of the asset, liability or transaction from which they are derived.

Women in Business 2025

Women in Business 2025

Progress towards gender parity in mid-market firms is moving in the right direction – but not quickly enough. For 21 years, we’ve tracked the ratio of women occupying senior management roles in mid-market firms around the world. In the last five years, we’ve seen sustained growth on this key measure, but the rate of change is still too slow.

Tax

Updated e-Invoice Guidelines and General FAQs: 21 & 22 February 2025

Updated e-Invoice Guidelines and General FAQs: 21 & 22 February 2025

Tax

Updated e-Invoice Guidelines and General FAQs : 28 January 2025

Updated e-Invoice Guidelines and General FAQs : 28 January 2025

MFRS

Get ready for MFRS 18 - Management-defined performance measures

Under the new requirements of MFRS 18, items of income and expense are not classified based on their own nature, but rather they are classified based on the nature of the asset, liability or transaction from which they are derived.

MFRS

Get ready for MFRS 18 - Classifying income and expenses

Under the new requirements of MFRS 18, items of income and expense are not classified based on their own nature, but rather they are classified based on the nature of the asset, liability or transaction from which they are derived.

MFRS

Get ready for MFRS 18

Entities should begin preparing for MFRS 18 ‘Presentation and Disclosure in Financial Statements’ sooner rather than later. Changes from MFRS 101 ‘Presentation of Financial Statements’ could have a significant impact on the financial statements.

Tax

Release of e-Invoice Rules, updated e-Invoice Guidelines and General FAQs: 1 October 2024 and 4 October 2024

The e-Invoice Rules [Income Tax (Issuance Of Electronic Invoice) Rules 2024] was released by the Ministry of Finance (MOF) on 1 October 2024 while both of the e-Invoice Guidelines (e-Invoice Guideline Version 4.0 and e-Invoice Specific Guideline Version 3.1) and e-Invoice General Frequently Asked Questions (FAQs) were updated by the Inland Revenue Board of Malaysia (IRBM) on 4 October 2024.

Sustainability

Malaysia’s Approach on Sustainability Reporting – IFRS S1 and S2

Malaysia’s Approach on Sustainability Reporting – IFRS S1 and S2

MFRS

Amendments to the Classification and Measurement of Financial Instruments

The Malaysian Accounting Standards Board (MASB) has released amendments to MFRS 9 (equivalent to IFRS 9) ‘Financial Instruments’ and MFRS 7 (equivalent to IFRS 7) ‘Financial Instruments: Disclosures’, following a post-implementation review (PIR) of MFRS 9 completed by International Accounting Standard Board (IASB). The amendments also include consequential changes to MFRS 19 (equivalent to IFRS 19) ‘Subsidiaries without Public Accountability: Disclosures’ to reflect the amendments made to MFRS 7.

IPO

Going Public: Transforming and creating value through IPO

Going Public: Transforming and creating value through IPO

Tax

Six-month interim relaxation period to issue consolidated e-invoice and the release of batch upload template and function

Six-month interim relaxation period to issue consolidated e-invoice and the release of batch upload template and function